SUCCESS STORIES

How ANZ used mapping in its merger with National Bank

During its merger with National Bank, New Zealand’s ANZ used ArcGIS software to help retain and attract customers. From building a single brand to achieving rationalization while expanding service coverage, mapping data and analytics ensured that the bank could answer the questions customers had—and many they hadn’t thought of.

Make every piece of information count

Successful financial institutions understand local consumers’ needs. Geographic variation in consumer and business behaviors and demands affect bank performance. Advanced maps and spatial analytics reveal deeper insight into relationships and patterns, answer complex questions, and inform decisions.

Get insight before action

Quickly analyze massive amounts of financial data to monitor performance and act on opportunity before the competition does.

Discover new markets and opportunities

Understand the needs of the customer and the underserved market to optimize your return on investment.

Ensure that the customer remains king

Increase value to customers and improve banking services with better customer insight and understanding.

EXPLORE A REAL-LIFE SCENARIO

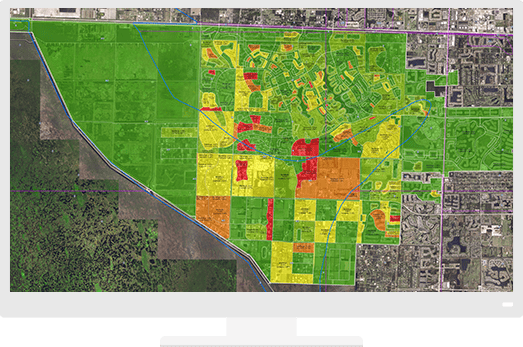

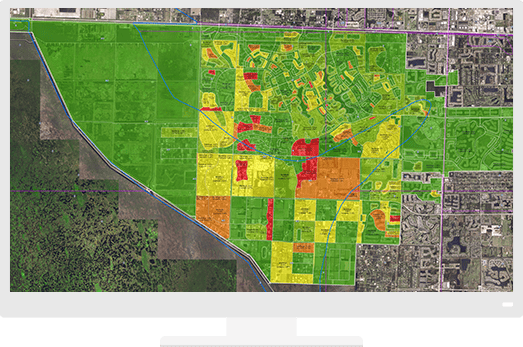

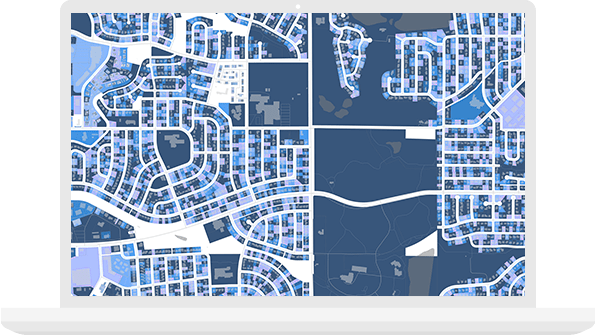

Bank managers need to identify growth opportunities

This financial services company needs to pinpoint areas that are suitable for new bank locations. First, analysts aggregate account holder data to determine where there are high concentrations of high-value individual accounts.

EXPLORE A REAL-LIFE SCENARIO

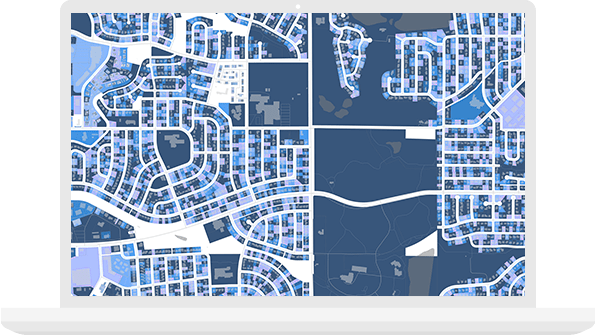

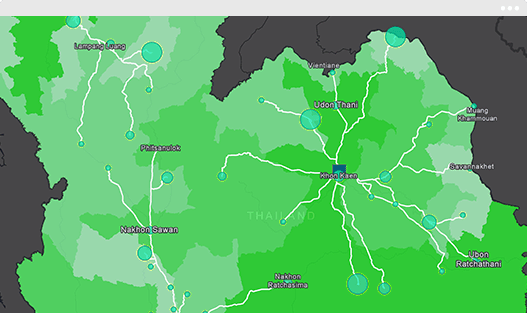

Analysts uncover hot and cold markets

Hot spot analysis shows markets in the South are growing in both number of accounts and per capita total account balances. It also shows that markets in the Northeast are cold.

EXPLORE A REAL-LIFE SCENARIO

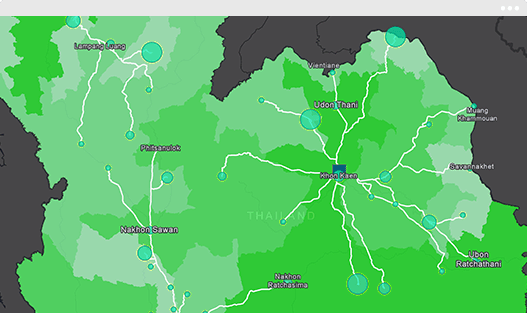

Demographic data enriches marketing outreach and expansion planning

Infographics show key neighborhood characteristics to inform which marketing approach will work best when targeting these potential customers. It informs a data-driven strategy on how to successfully expand into key markets.

SUCCESS STORIES

How ANZ used mapping in its merger with National Bank

During its merger with National Bank, New Zealand’s ANZ used ArcGIS software to help retain and attract customers. From building a single brand to achieving rationalization while expanding service coverage, mapping data and analytics ensured that the bank could answer the questions customers had—and many they hadn’t thought of.

Make every piece of information count

Successful financial institutions understand local consumers’ needs. Geographic variation in consumer and business behaviors and demands affect bank performance. Advanced maps and spatial analytics reveal deeper insight into relationships and patterns, answer complex questions, and inform decisions.

Get insight before action

Quickly analyze massive amounts of financial data to monitor performance and act on opportunity before the competition does.

Discover new markets and opportunities

Understand the needs of the customer and the underserved market to optimize your return on investment.

Ensure that the customer remains king

Increase value to customers and improve banking services with better customer insight and understanding.

EXPLORE A REAL-LIFE SCENARIO

Bank managers need to identify growth opportunities

This financial services company needs to pinpoint areas that are suitable for new bank locations. First, analysts aggregate account holder data to determine where there are high concentrations of high-value individual accounts.

EXPLORE A REAL-LIFE SCENARIO

Analysts uncover hot and cold markets

Hot spot analysis shows markets in the South are growing in both number of accounts and per capita total account balances. It also shows that markets in the Northeast are cold.

EXPLORE A REAL-LIFE SCENARIO

Demographic data enriches marketing outreach and expansion planning

Infographics show key neighborhood characteristics to inform which marketing approach will work best when targeting these potential customers. It informs a data-driven strategy on how to successfully expand into key markets.